Analysis

How to Analyze Bitcoin: Fundamental Vs. Technical?

Like any other financial asset, Bitcoin is also analyzed by two techniques:

Fundamental Analysis: Fundamental analysis is an approach which is used by the Bitcoin traders to determine the “intrinsic value” Bitcoin. This is done by a number of internal and external factors at large. For traditional asset classes such as equities, fixed income securities and commodities, it is easier to perform fundamental analysis. However, for cryptocurrencies various different parameters has to be looked upon to assess it fundamentally, such as whitepaper, liquidity and trading volume, fees, market capitalization and other project metrics.

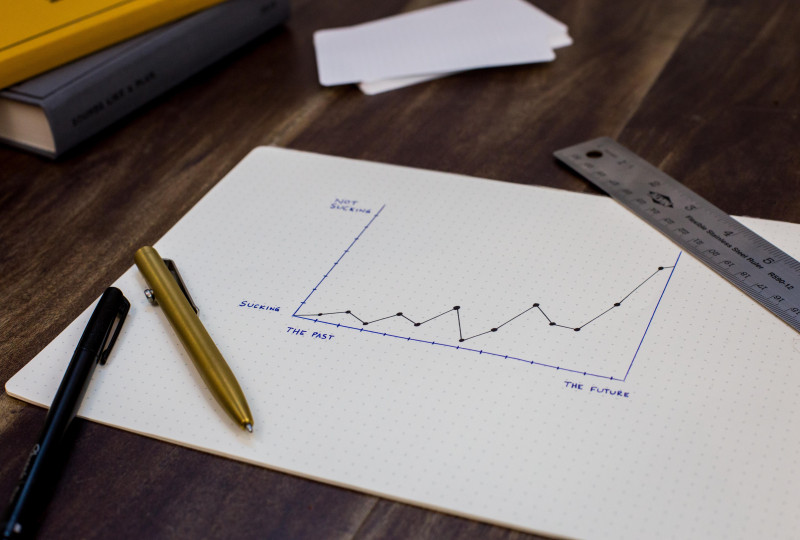

Technical Analysis: Simply put, technical analysis of Bitcoin includes reviewing the price patterns using various types of charting techniques such as a line chart, bar chart, candlesticks, etc. and applying technical analysis indicators. Such indicators are a combination of trend lines, support and resistance levels, moving averages, directional movement index, momentum indicators and extension, etc. Technical analysis indicators use the past prices of Bitcoin for forecasting its future price movement.

Bitcoin technical analysis usually relies on charting patterns, statistical indicators, or both. The most commonly used charts are candlestick, bar, line and bar charts. Each can be created with similar data but presents the information in different and useful ways.

Share This Blog